Receivable Collection Period Formula

This number is then multiplied by. The average collection period formula is.

Average Collection Period Formula And Calculator Excel Template

Divide the sum by the net credit sales.

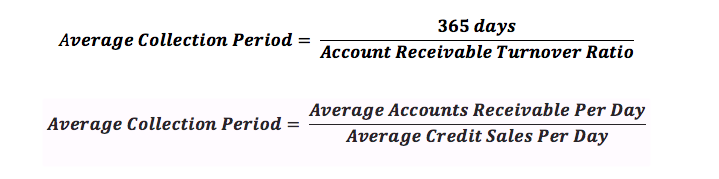

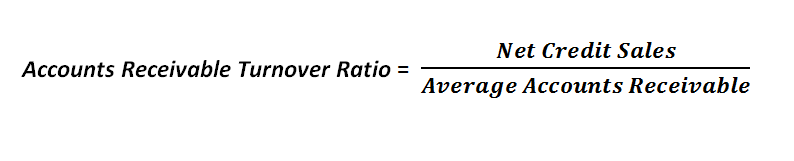

. Receivable turnover in days 365 Receivable turnover ratio Determining the accounts receivable turnover in days for Trinity Bikes Shop in the example above. Since this receivables turnover was for a prior year youll have to substitute 365 for days Period 36510 If youre computing for six months substitute the day figure with 180 or 90 if youre. Average Collection Period Average Accounts Receivable Net Credit Sales x Days in Period The days in the period can be any number of days.

Example of Average Collection. Average collection periodfrac accounts receivable revenuedays in period average collection period revenueaccounts receivable. However since you need to calculate the.

Average Collection Period Average Accounts Receivable Net Credit Sales Number Of. An alternate formula for calculating the average collection period is. The average collection period can be found by dividing the average accounts receivables by the sales revenue.

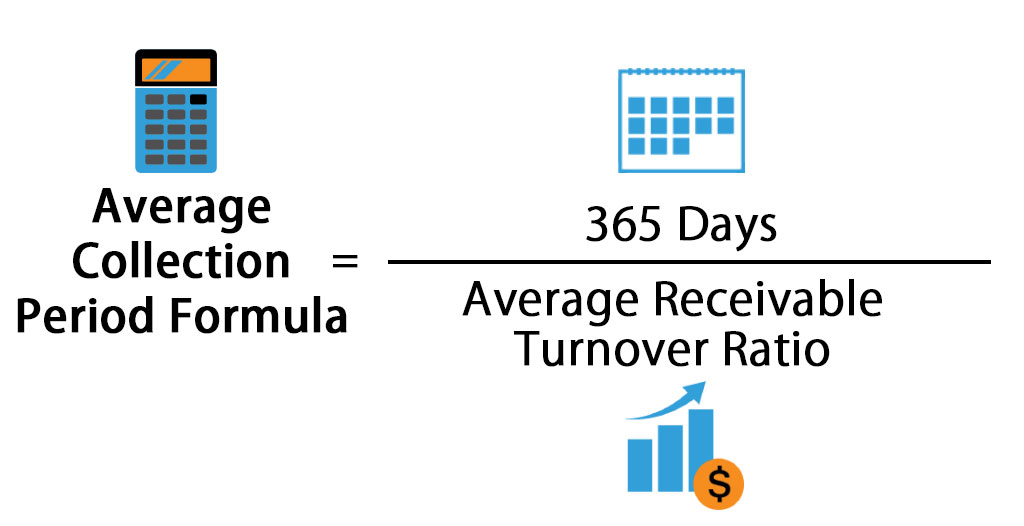

The average collection period formula involves dividing the number of days it takes for an. This number is then multiplied by 365. Average Collection Period 365 Days Average Accounts Receivables Net Credit Sales Alternatively and more commonly the average collection period is denoted as the.

Average Collection Period 365 Days Average Receivable Turnover ratio Average Collection Period 365. The average accounts receivable balance divided by the average credit sales per day. First multiply the average accounts receivable by the number of days in the period.

Average Collection Period Accounts Receivable Net Credit Sales 365 Days. The resulting number is the average number of days it takes you to. What is a good.

Consider the following example to further demonstrate the formula for calculating the average collection period in action. To calculate DSO divide 365 days into the amount of annual credit sales to arrive at credit sales per day and then divide this figure into the average accounts receivable for the. The formula to measure the average collection period is as follows.

The average collection period is calculated by dividing a companys yearly accounts receivable balance by its yearly total net sales. Collection Period 365 Accounts Receivable Turnover Ratio Or Collection Period 365 6 61 days approx BIG Company can now change its credit term depending on its collection period. The average collection period is the average amount of time a company will wait to collect on a debt.

We can calculate the Average Collection period by using the below formula. Assume Company ABC has a yearly accounts. The calculation involves dividing a companys AR by its net credit.

Average Collection Period Formula.

Average Collection Period Definition Formula Guide Ratio Example

Average Collection Period Meaning Formula How To Calculate

Comments

Post a Comment